Explore the digital future of insurance together with Thales at Insurance Innovators Nordics 2024

Date: 18 - 19 March 2024

We are excited to be a Gold Sponsor at Insurance Innovators Nordics 2024. During the summit, we'll share advanced identity technology, insurance trends, customer success stories, and showcase the crucial role of Customer Identity and Access Management in accelerating the digital transformation of the insurance industry.

Learn more about enabling frictionless onboarding and authorization for:

- Brokers

- Insurers

- Consumers

Meet the Thales Identity Team

Make the most out of the event by scheduling a one-on-one meeting with our CIAM experts. Gain deeper insights into Thales OneWelcome Identity Platform and learn how it can support your identity insurance journey.

Where: Thales Booth #7, Radisson Blu Scandinavia, Copenhagen

When: 18 - 19 March 2024

Video layout

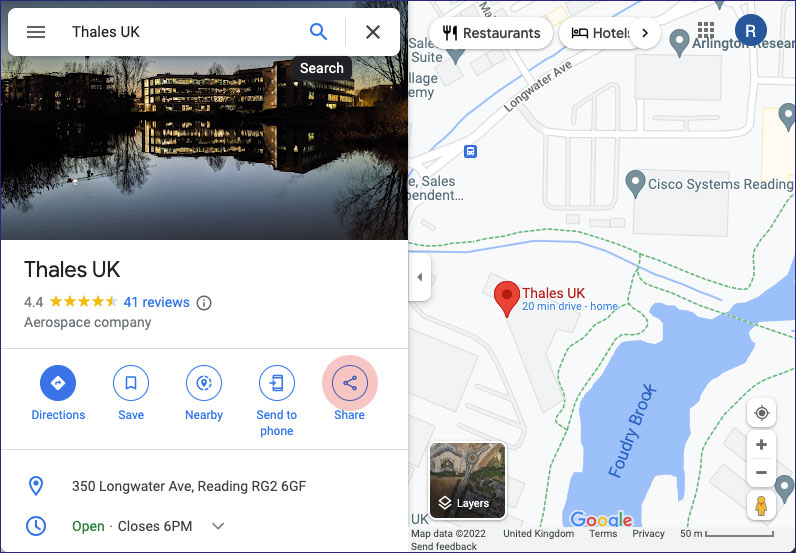

Venue

Radisson Blu Scandinavia, Copenhagen

Located in the city center just a short walk from many prominent company offices and attractions. Copenhagen Airport, Kastrup is just a 15-minute drive away.

On foot:

The hotel is only a 2-kilometer walk from Copenhagen Central Station (København H). Take Langebro across the canal.

By bus:

Take bus 5C toward Kastrup St and get off at the Klaksvigsgade (Amager Boulevard) stop. The hotel is just 250 meters from here.

Address: Amager Boul. 70, 2300 København, Denmark

Agenda

Morning Session

| Time | Topic |

|---|---|

| 09:00 - 10:00 | Registration and refreshments |

| 10:00 - 10:30 | Opening Ollie Omotosho, Strategic Partnerships Global Lead, Thales Ousmene Mandeng, Sr. Advisor Global Digital Assets, Accenture |

| 09:45 - 11:00 | Central Bank in Practice: Real Life Stories 01 CBDC Italy 02 Digital Euro Dr.Ilesh Dattani, CEO, Assentian |

| 11:30 - 11:45 | Coffee break |

| 11:45 - 12:15 | Panel – CBDC in Practice Q&A Ousmene Mandeng, Sr. Advisor Global Digital Assets, Accenture John Velissarios, Kazakhstan Digital Tenge Lead Advisor, Otranto Diego Ballon Ossio, Partner, Clifford Chance |

| 12:15 - 13:15 | Security in practice 03 Offline CBDC Alain Martin, Director Consulting and Industry Relations, Thales 04 Working in the real world Anthony Ralphs, Lead Product Manager - CBDC, Ripple |

| 13:00 - 14:15 | Lunch and networking |

Afternoon Session

| Time | Topic |

|---|---|

| 14:15 - 15:15 | Policy in practice 05 Internationalisation Dr Michael Lloyd, Global Policy Unit 06 Policy impacts BIS |

| 15:15 - 15:45 | CBDC in practice: Launched projects 07 Pilot stories Nick Kerigan, Managing Director, Head of Innovation, Swift |

| 15:45 - 16:00 | Coffee break |

| 16:00 - 16:30 | 08 National Bank of Kazakhstan John Velissarios, Digital Tenge Lead Advisor, Otranto |

| 16:30 - 16:45 | Close of conference Ollie Omotosho, Strategic Partnerships Global Lead, Thales |

| 16:45 - 17:45 | Drinks reception and Networking |

Speakers

Anhony Ralphs

Director of Product Management at Ripple for CBDCs

Anthony Ralphs is the Director of Product Management at Ripple for CBDCs. In his role, he supports the Ripple CBDC Platform. Ralphs has been involved in payments for nearly two decades working with banks, non-banking financial institutions, corporates, domestic clearing systems and global networks. He is passionate about payments and how technology can make the world of payments better while providing new opportunities to customers.

Ousmene Mandeng

Economist

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum sed lectus et nunc condimentum luctus vitae vel augue. Praesent orci lectus, vestibulum sed nibh vitae, placerat tincidunt mauris. Sed vel consequat enim, et fermentum felis. Aliquam et velit a diam viverra ullamcorper vitae pharetra erat.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum sed lectus et nunc condimentum luctus vitae vel augue.

Dr Ilesh Dattani

Founder and CTO of Assentian

Dr Ilesh Dattani is the founder and CTO of Assentian - a Cyber Security and Blockchain Lab based in the UK, United States and Ireland. He has a first degree in Mathematics from the University of London and a Master in Financial Mathematics and a Ph.D. in Machine Learning from Yale in the United States. He has over the last 20 years worked on innovative disruptive fintech solutions in areas including Digital Payments, High-Precision Real-Time Trading, Mobile Payments, Transaction Processing, Digital Identity, CBDC's and Fraud Detection. He is a member of the International Standards Organisations Committees on both Information Security and Artificial Intelligence. He acted as an advisor in supporting the overall delivery of a sub-project under the European Central Bank's Digital Euro Investigation Phase. He has an in-depth knowledge of developing DEFI solutions using Ethereum and Ripple. He is a Certified Information Security Auditor and manages the delivery of Information Security Compliance Services and Cyber Security Innovation Support into a number of European financial Institutions.

John Velissarios

Co-founder

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum sed lectus et nunc condimentum luctus vitae vel augue. Praesent orci lectus, vestibulum sed nibh vitae, placerat tincidunt mauris. Sed vel consequat enim, et fermentum felis. Aliquam et velit a diam viverra ullamcorper vitae pharetra erat.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum sed lectus et nunc condimentum luctus vitae vel augue.

Diego Ballon Ossio

Partner

Diego is a Partner in the financial regulatory practice in London, specialising in advising technology companies, financial institutions and other market participants on regulatory aspects of digital asset trading and custody including in respect of strategic interactions with UK and EU regulators.

Diego is a member of the UK Financial Markets Law Committee (FMLC) Working Group on Fintech and regularly participates in industry events related to digital assets and tokenisation.

He gained significant experience in financial regulation working at the UK Financial Conduct Authority (and predecessor organisation) from 2010 to 2015. He is ranked by Legal 500 as a “Rising Star”, is ranked by Chambers Fintech as an “Associate to Watch” and is also ranked in IFLR1000 for Financial Regulation.

Dr Michael Lloyd

Associate Director, Global Policy Institute (GPI London)

Michael Lloyd is Associate Director and a Senior Research Fellow at the international affairs think tank, the Global Policy Institute in London, and a former visiting fellow at Newcastle University. He studied political economy at Trinity College, Cambridge. Michael has wide experience as an applied economist in industry and in European international organizations and as an economic adviser, notably as a special Economic Adviser on Economic and Monetary Union to the European Parliament in 1998, covering preparations for the launch of the ECB in 1999. His specializations are monetary economics, the political economy of European integration, and wider geopolitical analysis.

Ollie Omotosho

Director of Strategic Partnerships for the Cloud Protection at Thales

Ollie Omotosho is the Director of Strategic Partnerships for the Cloud Protection division of Thales. He works with global Thales partners to help organisations achieve the security of data, AI, digital operations and financial systems. Having built technology markets for 20 years, he currently focuses on developing strategies to address digital sovereignty issues within cloud and financial transformation; issues which are magnified by AI, quantum, asset digitalisation and emerging technology across global markets.

Alain Martin

Head of Consulting & CBDC Lead | Banking & Payment Services - Thales

Alain Martin is in charge of consulting services for payment systems at Thales Banking and Payment Services. He represents Thales at the board of the Smart Payment Association. He also leads Thales’ CBDC initiative and is involved in various Proof of Concept and pilots with central banks, focusing on the support of offline payment.

Prior to this, he was in charge of strategic partnerships, liaising in particular with Visa and

Mastercard. He was responsible for the portfolio of mobile financial services products, addressing the mobile payment needs of banks, mobile operators and transport operators. He was for eight years regional managing director for Gemalto’s POS terminal division in the Europe, Middle East and Africa region.

Overall, Mr Martin has 30+ years of experience in the payment industry, 4 of which spent in the USA. He holds a Master's Degree in Electrical Engineering from Institut National des Sciences Appliquées in Lyon, France.

Pallavi Thakur

Director of Strategy and Innovation Group at Swift

Pallavi Thakur is Director of Strategy and Innovation Group at Swift.

In that role, she is responsible for stewarding the innovation strategy for new digital networks and explore new support new products and services. She is currently leading Swift’s CBDC and Interoperability initiatives with the financial community and FinTech’s.

Pallavi has worked for 17 years in payments, banking and capital markets across a multitude of technologies including blockchain and DLT. Prior to joining Swift, she was the Head of Product for Digital Currencies at R3. Her expertise is in digital payments, new financial market infrastructures and product development which is grounded in behavioural trends and customer needs.

Quote, Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum sed lectus et nunc."

—Full Name and Job Title

Sponsors

|

|

Book your meeting

Please enter a valid email

This field cannot be blank

Your personal data is collected and processed by THALES in order to stay in touch with you. You can manage your email preferences or unsubscribe at any time. We will process your data with respect and in accordance to our privacy notice.